Introduction

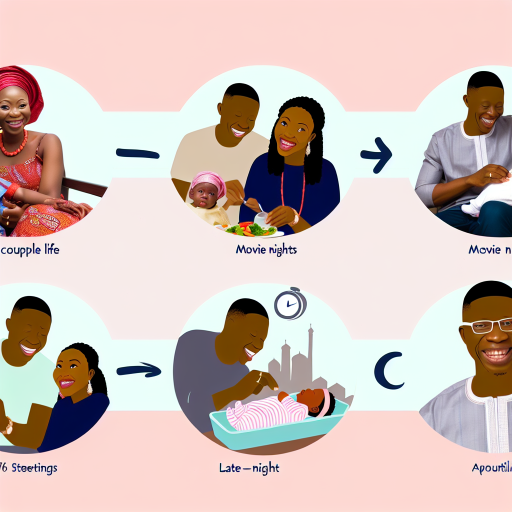

Starting a family financially and emotionally is a significant milestone for many couples in Nigeria.

Proper preparation is crucial for success.

Many factors influence family life, making this journey challenging yet rewarding.

Importance of preparing for family life in Nigeria

In Nigeria, family plays a central role in social structures.

Preparing for family life helps build a solid foundation for happiness.

It allows couples to better handle the responsibilities of parenting and partnership.

Financial stability ensures that you can provide adequately for your children.

Emotional readiness fosters resilience during tough times.

Preparing effectively creates a nurturing environment where your family can thrive.

Overview of financial and emotional aspects

Financial preparation involves budgeting, saving, and investing.

Assess your current financial situation honestly.

Understanding your income and expenses equips you for family planning.

Explore various savings options like health insurance and educational funds.

Building a safety net protects your family against unexpected expenses.

On the emotional side, communication is vital.

Engage in open discussions about your expectations and fears.

Develop conflict-resolution skills to handle disagreements constructively.

Consider attending family counseling sessions, which can strengthen your relationship.

Creating a support network of friends and family helps during challenges.

This network also celebrates your successes with you.

Challenges and rewards of starting a family

Starting a family brings both challenges and rewards.

The responsibilities can overwhelm new parents, creating stress.

Financial strains can also emerge, depending on your background and resources.

However, the joys of parenthood offer incredible fulfillment.

Each milestone in your child’s growth fills you with pride and happiness.

By preparing financially and emotionally, you enhance your family’s chances of success.

Embrace the journey with optimism and commitment.

Understanding the Financial Landscape

Starting a family in Nigeria requires a solid grasp of the financial landscape.

Understanding the cost of living is essential for prospective parents.

Nigeria boasts a diverse economic environment that affects finances based on location.

This section explores the typical expenses involved in starting a family and highlights regional differences in costs.

Overview of the Cost of Living in Nigeria

The cost of living in Nigeria varies widely, influenced by urbanization and local economic conditions.

Major cities like Lagos and Abuja have higher living costs than rural areas.

As you prepare for a family, consider these components:

- Housing: Rent prices can differ significantly based on the city and neighborhood.

- Utilities: Electricity, water, and internet expenses can add to monthly bills.

- Transportation: Fuel costs vary, along with public transport fares.

- Food: Costs for groceries and dining out fluctuate based on location and availability.

- Healthcare: Access to quality medical care can impact expenses.

Typical Expenses for Starting a Family

Financial planning involves identifying key expenses related to starting a family.

Consider the following typical expenses:

Housing

Housing is one of the most significant expenses.

Determine whether to rent or buy:

- Rent: Monthly rent can range from ₦50,000 to ₦1,000,000 depending on the city.

- Buying: The cost of purchasing a home varies greatly based on location and size.

Healthcare

Healthcare is crucial when starting a family.

Expect costs in the following areas:

- Maternity services: Hospital bills can range from ₦50,000 to ₦300,000.

- Pediatric care: Regular check-ups can cost around ₦5,000 to ₦10,000 per visit.

- Health insurance: Premiums vary based on coverage; expect ₦15,000 to ₦50,000 monthly.

Education

Education costs begin with daycare and evolve as children grow.

Consider the following estimates:

- Preschool: Tuition fees can range from ₦30,000 to ₦150,000 per term.

- Primary school: Private primary schools charge between ₦100,000 and ₦500,000 annually.

- Secondary school: Costs increase, with fees ranging from ₦150,000 to ₦1,000,000 annually.

Regional Differences in Costs

Nigeria’s regional diversity affects living costs significantly.

Major cities demand higher expenses compared to rural areas.

Here’s a breakdown of some regional differences:

Lagos

Lagos is Nigeria’s largest city.

It offers vast opportunities but comes with higher costs:

- Housing: High rental prices, with two-bedroom apartments starting around ₦100,000 monthly.

- Healthcare: Access to several private hospitals, but fees can be steep.

- Transportation: Daily commutes can be costly due to traffic and fuel expenses.

Abuja

As the capital, Abuja also has a high cost of living:

Parenting Made Just for You

Get personalized Parenting Solutions tailored to your child’s needs. Transform your parenting journey with expert guidance in 1-3 days.

Get Started- Housing: Prices for a three-bedroom apartment can exceed ₦200,000 monthly.

- Education: International schools can charge upwards of ₦600,000 annually.

- Healthcare: Adequate health facilities, but fees can add up quickly.

Rural Areas

The cost of living significantly decreases in rural regions:

- Housing: Rent costs can be as low as ₦20,000 for basic accommodations.

- Food: Local produce offers lower grocery costs compared to cities.

- Healthcare: Limited options lead to lower costs, but access could be an issue.

Strategies for Financial Preparation

To prepare financially for starting a family, adopt the following strategies:

- Budgeting: Create a budget to manage monthly expenses effectively.

- Saving: Establish a dedicated savings account for family-related costs.

- Investing: Consider investment opportunities for long-term financial growth.

- Financial education: Educate yourself about financial management and planning.

Understanding the financial landscape in Nigeria is a vital step towards starting a family.

Grasping costs related to housing, healthcare, and education ensures preparedness.

Remaining aware of regional cost differences allows for informed decisions.

By implementing sound financial strategies, prospective parents can achieve the stability they need for a successful family life.

Budgeting for Family Expenses

Creating a family budget is a crucial step when preparing for family life in Nigeria.

It helps ensure that your financial resources are allocated wisely.

A well-structured budget can help build a secure foundation for your family’s future.

Below, we discuss how to create a family budget, distinguish between essential and non-essential expenses, and provide tips for tracking and managing your family finances.

How to Create a Family Budget

Creating a budget involves several clear steps.

Follow these steps to make the process manageable:

- List all sources of income: Include salaries, allowances, and any side businesses.

- Identify all necessary expenses: These may include rent, utilities, education, and transportation.

- Gather data on monthly spending: Review bank statements and receipts to understand spending habits.

- Categorize expenses: Divide your expenses into two categories: essential and non-essential.

- Set spending limits: Establish a maximum amount to spend in each category based on income and essential needs.

- Track your spending: Keep a daily or weekly record to stay on top of your budget.

- Review and adjust: At the end of each month, assess your budget.

Make necessary adjustments for the following month.

Essential vs. Non-Essential Expenses

Understanding the difference between essential and non-essential expenses is vital for effective budgeting.

Here’s how to differentiate them:

Essential expenses

These are costs that are necessary for basic living and survival.

Examples include:

- Housing (rent or mortgage)

- Utilities (water, electricity, gas)

- Groceries and household supplies

- Transportation (fuel, public transport)

- Healthcare (medical insurance, medications)

- Education (tuition fees, school supplies)

Non-essential expenses

These involve costs that enhance your lifestyle but are not necessary.

Examples are:

- Dining out and entertainment

- Luxury items and brand-name goods

- Subscription services (streaming, magazines)

- Vacations and leisure travel

- Hobbies that require significant spending

It is essential to prioritize essential expenses when creating your budget.

Identify areas where non-essential costs can be reduced or eliminated.

This approach will free up funds for savings and investments for your family’s future.ced or eliminated.

This approach will free up funds for savings and investments for your family’s future.

Tips for Tracking and Managing Family Finances

Managing family finances becomes easier with consistent tracking.

Here are impactful tips to consider:

- Utilize budgeting apps: Use digital tools such as Mint or YNAB (You Need a Budget) to automate your tracking.

- Maintain a physical ledger: Record transactions monthly in a budget book for those who prefer a tangible method.

- Create sinking funds: Set aside money for irregular expenses, like school fees or medical emergencies, to avoid unexpected financial stress.

- Involve all family members: Engage your partner and children in budgeting discussions.

This teaches financial responsibility at an early age. - Set short-term and long-term financial goals: Outline achievable goals, such as saving for a family trip or a new car.

This gives focus to your budgeting efforts. - Regularly review your budget: Set time each month to review spending against your budget.

This allows for necessary adjustments. - Prioritize debt repayment: If you have outstanding debts, plan a strategy to eliminate them without accumulating more.

- Look for discounts and deals: Take advantage of sales, promotions, and discount offers when grocery shopping or purchasing essentials.

- Invest in education and skill development: Continuously learn about budgeting and financial management to empower yourself and your family.

By following these tips, you will create a solid financial framework for your family.

Effective managing of family finances ensures that you are prepared for inevitable expenses.

Adjust your financial strategies as circumstances change, like job loss or unexpected medical expenses.

In fact, budgeting for family expenses is essential for raising a family in Nigeria.

Start by gathering your income information and tracking your spending.

Distinguish between essential and non-essential expenses, and make informed decisions about your finances.

Utilizing effective tracking methods while involving your family will ease the financial management process.

Maintain flexibility in your budgeting to ensure that it remains a living document responsive to your family’s needs.

Emergency Funds and Savings

Starting a family is a significant venture.

It requires not only emotional readiness but also financial preparedness.

One essential aspect of this financial preparation is establishing an emergency fund.

An emergency fund serves as a financial safety net during unpredictable circumstances.

It keeps families stable during times of uncertainty, especially with a new child in the mix.

Importance of Having an Emergency Fund

- Protects Against Unexpected Expenses: Life often throws curveballs.

An emergency fund cushions families against sudden medical bills, car repairs, or job loss. - Reduces Financial Stress: Financial worries can strain relationships.

Having savings reduces anxiety about making ends meet. - Improves Decision-Making: When financial pressure alleviates, families make healthier choices.

This proactive approach secures a better family life. - Encourages Financial Discipline: Saving regular amounts develops a habit of financial discipline.

This habit benefits the family over the long term. - Provides Flexibility: An emergency fund gives families flexibility.

It allows them to respond swiftly to opportunities without adding debt.

Suggested Amount to Save for Different Family Scenarios

Determining the right amount to save can depend on various family scenarios.

Here are some guidelines to help families decide:

Unveil the Perfect Name that Tells Your Family's Story

Let us help you find a name that embodies your family's values, traditions, and dreams. Our personalized consultation weaves cultural insights to create a name that's uniquely yours.

Get Started- For a Family of Two: Aim for at least three to six months’ worth of living expenses.

This amount allows for reasonable stability during emergencies. - For Expecting Parents: Consider saving six to twelve months of expenses.

The transition to parenthood comes with new costs and uncertainties. - For Families with One Child: A fund of six to twelve months’ expenses covers potential childcare and healthcare costs.

- For Large Families: Save at least twelve months of living costs.

Increased family size often leads to increased unexpected expenses. - Single Parents: Fund up to six to twelve months of expenses to mitigate risks.

Single-income households face unique financial pressures.

Effective Saving Strategies for Families

Establishing a solid emergency fund requires strategic planning and consistent effort.

Here are effective saving strategies for families:

- Create a Family Budget: Track income and expenses diligently.

Categorize spending to identify saving opportunities. - Set Specific Savings Goals: Establish measurable goals for your emergency fund.

Break these into monthly or weekly targets. - Automate Savings: Set up automatic transfers to a dedicated savings account.

This ensures consistent contributions toward your goal. - Cut Unnecessary Expenses: Review monthly expenses and eliminate non-essential items.

Redirect these savings to your emergency fund. - Involve the Family: Discuss saving goals with your family.

Encourage everyone to contribute ideas on how to save together. - Utilize Windfalls Wisely: Put bonuses, tax refunds, or unexpected income into your fund.

Windfalls can accelerate your savings. - Use Separate Accounts: Open a high-interest savings account for your emergency fund.

Keeping it separate prevents unnecessary withdrawals. - Review and Adjust Regularly: Reassess your budget and savings goals quarterly.

Adjust to meet your family’s evolving needs. - Invest in Financial Education: Continuously educate yourself on personal finance.

Knowledge empowers families to make informed financial decisions. - Start Early: Begin saving early to create financial security.

Build your emergency fund before the baby arrives.

Basically, saving for a family requires careful planning.

Establishing an emergency fund protects your family from unforeseen events.

Understanding how much to save based on your family’s unique circumstances is essential.

By following these strategies, you build a strong financial foundation for your growing family.

An emergency fund is more than just savings.

It’s the cornerstone of financial security, allowing families to thrive through the journey of parenthood in Nigeria.

Start today for a secure future.

Read: Smart Tips for Starting a Family in Nigeria

Insurance Considerations

The decision to start a family involves careful planning and preparation.

One of the fundamental aspects to consider is insurance.

Insurance protects your family from unforeseen financial burdens and promotes overall well-being.

Below are some essential insurance considerations for families in Nigeria.

Types of Insurance Suitable for Families

When planning for a family in Nigeria, understanding the types of insurance available is crucial.

There are three primary types of insurance you should consider:

- Health Insurance: This coverage pays for medical expenses.

It covers hospital visits, surgeries, and routine checkups.

Having health insurance helps reduce out-of-pocket costs and provides peace of mind. - Life Insurance: This policy ensures financial protection for your family in the event of your untimely death.

It can cover everyday expenses, education, and outstanding debts.

Life insurance gives your family a safety net during difficult times. - Property Insurance: This type protects your home and belongings against damages or losses.

It can cover theft, fire, and natural disasters.

Property insurance is essential for safeguarding your most significant investments.

Benefits of Insurance in Safeguarding Family Finances

Insurance provides numerous benefits that can significantly enhance your family’s financial security.

Here are some key advantages:

- Financial Security: Insurance helps stabilize family finances by providing essential safety nets.

It mitigates risks associated with unpredictable life events. - Pain-free Medical Expenses: With health insurance, unexpected medical costs become manageable.

It ensures timely medical attention without financial strain. - Peace of Mind: Knowing your family is protected from financial catastrophes brings emotional comfort.

This peace of mind allows you to focus on family growth. - Future Planning: Life insurance assists in long-term financial planning.

It ensures that your children’s education and future are taken care of, even in your absence. - Asset Protection: Property insurance safeguards your home and belongings.

It helps replace or repair your assets in case of damage or loss.

How to Choose the Right Policies

Selecting the right insurance policies requires thoughtful consideration.

Here are steps to guide your decision-making process:

- Assess Your Needs: Begin by evaluating your family’s specific needs.

Consider medical conditions, children’s education, and property value in your assessment. - Research Providers: Investigate various insurance companies.

Look for those with strong reputations and financial stability.

Read reviews and testimonials online to gauge client satisfaction. - Compare Policies: Once you identify potential providers, compare their offerings.

Consider coverage limits, premium costs, and any exclusions in each policy. - Consult Professionals: Speak to insurance brokers or financial advisors.

They can offer insights tailored to your situation and help you make informed decisions. - Understand Terms and Conditions: Thoroughly read the policy documents before purchasing.

Understanding terms, conditions, and exclusions helps avoid unpleasant surprises later. - Evaluate Costs: Determine how much you can afford in premiums.

Balance affordability with adequate coverage to ensure financial protection. - Review and Update Regularly: As your family grows and circumstances change, revisit your insurance policies.

Ensure they meet your evolving needs and life situation.

Starting a family is a joyous journey filled with hopes and dreams.

However, it also comes with responsibilities and uncertainties.

Insurance can serve as a pillar of support that strengthens your financial foundation.

By considering the types of insurance available, understanding their benefits, and making informed choices, you can create a secure environment for your family.

In essence, navigating the complexities of insurance may initially seem daunting.

Embrace the process by focusing on your family’s specific needs.

With careful planning and the right policies, your family can thrive even in challenging circumstances.

In the long run, proper insurance coverage is not just about protecting finances; it is about ensuring peace of mind and creating a safe environment for your loved ones.

Read: Gender Bias in Nigerian Society: A Parent’s View

Planning for Education

Planning for education in Nigeria requires careful consideration of various costs associated with different educational levels.

Families must understand these costs to make informed financial decisions.

Breakdown of Educational Costs

Each educational level has its own unique costs.

Understanding these costs helps families plan effectively.

Here’s a breakdown:

Primary Education Cost

- Tuition fees may range from ₦20,000 to ₦200,000 per year.

- Additional costs include uniforms, books, and supplies.

- Extracurricular activities often incur extra fees.

Secondary Education Costs

- Tuition fees typically range from ₦50,000 to ₦300,000 annually.

- Students may require more textbooks and materials.

- Extracurricular activities and school trips add to costs.

Tertiary Education Costs

- Tuition fees vary significantly by institution, from ₦100,000 to ₦600,000 per year.

- Accommodation, transportation, and feeding costs increase expenses.

- Some courses require additional fees for materials and equipment.

Importance of Early Savings for Education

Starting a family entails preparing for your child’s future in many ways, especially education.

Early savings for education offer numerous benefits:

- Allows parents to spread costs over time, reducing financial burden.

- Ensures that parents can afford quality education without debt.

- Provides peace of mind knowing funds are available when needed.

- Enables parents to take advantage of compounding interest over time.

- Ensures parents can respond to rising educational costs effectively.

Starting a savings plan early sets a solid foundation for your child’s education.

The earlier you begin, the more you can save with less monthly effort.

Available Educational Savings Plans and Investment Options

Families can choose from various savings plans and investment options to secure their children’s education.

Here are some popular options available in Nigeria:

Fixed Deposit Accounts

- Offers guaranteed returns over a specified period.

- Low risk with stable interest rates, but limited access to funds.

Savings Accounts for Children

- Provides higher interest rates than regular savings accounts.

- Encourages children to develop saving habits from a young age.

Educational Insurance Policies

- Provides a lump sum payment upon maturity or in case of unforeseen events.

- Generally covers fees until your child completes tertiary education.

Mutual Funds

- Allows investment in a diverse portfolio of stocks and bonds.

- Offers potential higher returns, though with associated risks.

Government Bonds

- Low-risk investment option backed by the government.

- Tends to provide fixed interest rates over time.

Each of these options has its pros and cons.

Consider your financial situation and goals when choosing a suitable plan.

Therefore, planning for education in Nigeria is crucial for every family.

Understanding the costs involved at different educational levels helps parents adequately prepare.

Early savings are essential in managing these costs over time, allowing you to stay ahead of rising fees.

Furthermore, the right financial products can offer peace of mind.

The investment options available allow families to choose the best approach that meets their individual needs and financial situations.

By taking proactive steps now, you can secure a bright and stable educational future for your children.

Read: Gender and Health: Nigerian Parental Concerns

Emotional Preparation for Parenthood

Starting a family is an extraordinary emotional journey.

Expecting parents face a blend of excitement and uncertainty.

Emotions can fluctuate as you navigate this new chapter.

It’s crucial to grasp these feelings for a smooth transition into parenthood.

Understanding the Emotional Journey of Starting a Family

- Anticipation and Joy: Most expectant parents feel happiness.

The joy of bringing new life into the world is profound. - Anxiety and Fear: Concerns about parenting abilities often arise.

Doubts can creep in about meeting a child’s needs. - Adjustment Challenges: New parents must adapt to a changing dynamic.

Balancing work, personal life, and responsibilities presents challenges. - Identity Shifts: Becoming a parent changes your identity.

You may feel a loss of independence and changes in social dynamics. - Bonding with the Baby: Overcoming initial challenges to bond is vital.

It could take time to establish a strong connection.

Understanding these emotional stages is important.

You should identify each phase as it occurs.

This awareness helps in addressing feelings effectively.

Coping with Prenatal and Postnatal Challenges

Coping with challenges during pregnancy and after childbirth is essential.

Both prenatal and postnatal periods come with distinct emotional hurdles.

Here are some thoughts on managing these challenges:

- Education: Learn about pregnancy and childbirth.

Knowledge reduces fears related to the unknown. - Seek Support: Surround yourself with supportive friends and family.

Sharing experiences and feelings eases emotional burdens. - Professional Help: Don’t hesitate to engage professionals.

Therapists can provide valuable emotional support when needed. - Practice Self-Care: Make self-care a priority.

Take time for relaxation and recharging your energy. - Mental Health Awareness: Monitor your mental health.

Recognize signs of postpartum depression and anxiety.

Seek help promptly if needed.

By adopting these coping strategies, expectant parents can navigate emotional challenges with greater ease.

Both prenatal and postnatal phases require patience and understanding.

Importance of Open Communication with Partners

Clear and honest communication with your partner plays a pivotal role in emotional well-being.

Many conflicts arise from misunderstandings during this transition.

Here’s how to foster effective communication:

- Share Your Feelings: Openly express fears, hopes, and anxieties.

Sharing vulnerabilities creates a deeper connection. - Active Listening: Listen to your partner’s feelings without interrupting.

Validate their experiences and emotions. - Regular Check-ins: Schedule regular emotional check-ins.

Discuss stresses and achievements as a couple. - Avoid Blame: Address issues without accusing each other.

Focus on solutions rather than dwelling on problems. - Set Boundaries: Discuss parental responsibilities clearly.

Agree on roles to negate misunderstandings later.

Through open communication, couples can navigate the emotional challenges together.

Building a strong foundation helps in facing parenthood collectively.

Preparing Together

Emotional preparation should involve both partners working as a united front.

Addressing each other’s needs while managing individual feelings is essential.

Jointly preparing for parenthood helps prevent future conflicts.

Here are some tips for preparing together:

- Attend Classes: Participate in antenatal classes together.

Learning together strengthens your partnership and teamwork. - Discuss Parenting Styles: Talk about how you envision parenting.

This creates alignment on values and expectations. - Explore Each Other’s Past: Share parenting experiences from your own childhood.

Understanding backgrounds helps in decision-making. - Share Household Duties: Divide responsibilities before the baby arrives.

Creating a smooth daily routine will be necessary. - Forge Emotional Connections: Spend quality time together before the baby’s arrival.

Strengthening your bond helps ease transitions.

By preparing together, couples can build a harmonious environment for their growing family.

This unity promotes emotional well-being, making parenthood more manageable.

In short, emotional preparation is as crucial as financial preparation.

Expectant parents must embrace the emotional journey.

Understanding, coping strategies, and communication can ease the transition into parenthood.

Strive for an emotionally supportive environment as you embark on this significant life journey.

Read: Gender-Specific Challenges in Nigerian Parenting

Building a Support Network

Starting a family can be both exciting and overwhelming.

It’s crucial to recognize that every new journey needs a solid support network.

Family, friends, and the community play a pivotal role in your family life.

They provide emotional, physical, and informational support during this transition.

Their involvement can shape your family dynamics and well-being.

The Role of Family, Friends, and Community in Family Life

Family, friends, and your community offer a variety of support forms.

Understanding these roles helps you appreciate their importance:

- Emotional Support: Loved ones provide encouragement and reassurance.

They listen to your worries and celebrate your joys. - Practical Help: Family and friends can assist with daily tasks.

They can babysit, cook meals, or help with chores. - Childcare Advice: Experienced relatives often share valuable parenting tips.

Their insights can guide you through challenges. - Social Connections: Friends can introduce you to other parents.

This expands your social circle and enhances your support network. - Financial Assistance: In some cases, family may offer financial help.

This can ease the burden of childbirth and early parenting costs.

How to Establish a Support Network

Building a supportive network requires effort and intention.

Here are actionable steps you can take:

- Reach Out to Family: Start by discussing your plans with close relatives.

Let them know you value their support. - Reconnect with Friends: Look for friends who are starting families.

Share experiences and lean on each other for support. - Join Social Groups: Search for parenting groups online or in your community.

Engaging with others can lead to lasting friendships. - Participate in Parenting Forums: Online parenting forums provide a wealth of information.

They allow you to connect with fellow parents. - Attend Community Events: Get involved in local events.

These gatherings offer opportunities to meet new people. - Volunteer for Parent Groups: Many organizations welcome help.

Volunteering connects you with like-minded individuals.

Importance of Seeking Advice and Mentorship

Mentorship is invaluable during the family planning process.

Seek guidance from those who have tread a similar path.

Here’s why mentorship matters:

- Real-Life Experience: Mentors offer practical insights drawn from their experiences.

This knowledge is often more valuable than theoretical advice. - Coping Strategies: An experienced mentor can share coping mechanisms for stress.

Their wisdom can help you navigate tough times. - Inspiration: Mentorship can inspire personal and family growth.

Learning from others’ successes can motivate you. - Networking Opportunities: Mentors can introduce you to their networks.

These connections can open doors for additional support. - Accountability: A mentor encourages you to stay focused on your goals.

Regular check-ins help maintain your commitment to starting a family.

Moreover, utilizing technology can enhance your support network.

Online platforms and social media allow you to connect with others quickly.

This connectivity broadens your reach and helps you find the right support.

Ultimately, as you prepare for family life, keep yourself open to the support around you.

Every relationship can add value to your journey.

Each connection nurtures a sense of belonging, reinforcing your commitment to starting a family.

Remember, it takes a village to raise a child, and a strong network is a cornerstone.

Generally, building a robust support network is essential when preparing to start a family in Nigeria.

Embrace your family and friends, and actively seek new connections.

Consider mentoring relationships that contribute positively to your experience.

Each step taken towards establishing this support system ensures you are better equipped for the journey ahead.

Balancing Work and Family Life

Understanding the Challenges of Juggling Work and Family Responsibilities

Starting a family in Nigeria brings unique challenges.

One of the foremost challenges is finding the right balance between work and family.

Many parents feel overwhelmed by their duties.

They often struggle to meet expectations at work while being present at home.

The competing demands from both spheres can lead to stress and burnout.

Recognizing these challenges is the first step toward managing them effectively.

Parents often face long working hours, which reduces time spent with family.

The work culture in Nigeria often emphasizes dedication and long hours.

This can leave little room for family activities.

Additionally, high living costs can compel parents to work extra hours.

Consequently, family time gets sacrificed for financial needs.

Parents must also deal with child-related responsibilities, such as schooling and healthcare.

Balancing these responsibilities with work obligations can be daunting.

Moreover, societal expectations can intensify this challenge.

In Nigeria, there are traditional views about gender roles.

Often, women bear the brunt of balancing work and family.

This situation can foster resentment and anxiety among parents.

They may feel inadequate as both caregivers and professionals.

Understanding these dynamics is essential to navigate them better.

Time Management Strategies for Parents

Effective time management stands as a crucial skill for parents.

Implementing a few strategies can significantly alleviate stress.

Consider these time management techniques:

- Prioritize Tasks: Use lists to identify and focus on critical tasks.

- Set Clear Goals: Define short-term and long-term family and work goals.

- Create a Daily Schedule: Plan daily activities, allocating time for work and family.

- Use Technology Wisely: Utilize apps for reminders, calendar events, and task management.

- Limit Distractions: Designate specific work times and minimize interruptions.

- Establish Routines: Foster a predictable structure for daily activities.

- Delegate Responsibilities: Share household tasks with partners or older children.

- Adopt Flexibility: Be willing to adapt plans as family needs evolve.

Relying on these strategies can help allocate time efficiently.

Prioritizing work tasks during productive hours can yield better results.

Reserve evenings and weekends for quality family time.

This separation can foster stronger family bonds.

Importance of Setting Boundaries and Prioritizing Family Time

Setting boundaries is critical for maintaining a healthy work-life balance.

Clear boundaries help distinguish between work and family time.

This practice encourages mindfulness during family activities.

Parents can enjoy moments without professional distractions.

Therefore, families become closer and more connected.

Establish work hours and stick to them.

Communicate your schedule with colleagues and supervisors.

Make it known that family time is important.

When work demands exceed boundaries, assess the necessity.

It’s crucial to learn to say “no” to avoid overwhelming yourself.

Furthermore, prioritize family activities.

Schedule regular family outings or game nights.

Engage in activities that everyone enjoys.

These experiences create lasting memories and strengthen bonds.

Make attending school events a priority to support your children.

This presence shows that you value their experiences.

In addition, practice self-care. Taking care of your well-being is essential for family harmony.

Regular exercise, hobbies, and downtime help recharge emotional reserves.

When parents are physically and mentally healthy, they exhibit more patience and positivity.

This attitude benefits the entire family dynamic.

Finally, involve children in household responsibilities.

Teaching kids skills is a valuable investment.

They learn teamwork and responsibility, easing parental burdens.

Assign age-appropriate tasks like cleaning or meal preparation.

This practice fosters a sense of achievement in children.

Balancing work and family life can be challenging for parents in Nigeria.

The pressures of work and societal expectations can create stress.

However, by implementing effective time management strategies, establishing boundaries, and prioritizing family time, parents can create a more harmonious environment.

Building strong family connections requires effort and intentionality.

With dedication and these strategies, parents can achieve a well-rounded work-life balance that nurtures both their professional ambitions and family ties.

Ultimately, investing in family relationships leads to a fulfilling and happy family life.

Embrace these challenges, learn from them, and enjoy the rewarding journey of parenthood.

Conclusion

Starting a family in Nigeria requires careful financial and emotional planning.

Couples should recognize the importance of budgeting for new expenses.

From prenatal care to diapers and education, initial costs can add up quickly.

Emotionally, both partners should communicate their expectations and fears.

Understanding each other’s viewpoints fosters a supportive environment.

Anticipate changes in relationships and roles, as these can significantly impact family dynamics.

It is crucial to develop a savings plan to manage unexpected costs.

Create an emergency fund specifically for child-related expenses.

This fund provides peace of mind during uncertain times.

Additionally, consider investing in health insurance or a medical savings plan.

Quality healthcare is vital for both parents and children.

Being proactive about these financial considerations lays a solid foundation for your family’s future.

Moreover, explore government support and community resources available for new families.

Various programs can provide invaluable assistance during this transition.

Tapping into these resources may alleviate some financial stress.

As you prepare, cultivate emotional resilience.

Parenthood brings joy, but it also presents challenges.

Building a strong emotional support network helps navigate these obstacles effectively.

Ultimately, approach family planning with a well-rounded perspective.

Balance your financial and emotional readiness.

Equipping yourselves with knowledge and resources makes the journey smoother.

We encourage you to take proactive steps in your preparation efforts.

Start budgeting, communicating openly, and seeking resources today.

When both partners are prepared, you build a nurturing environment for your future family.

Remember, the journey of starting a family is unique for everyone.

With thoughtful planning and commitment, you can create a loving and secure home.