Understanding Family Debt

Definitions and Implications in Nigerian Context

Family debt refers to money owed by a household, impacting its finances.

It can include loans, mortgages, and credit card balances.

In Nigeria, rising costs often lead families to accumulate debt.

Understanding these debts is crucial for effective management.

Debt can strain family relationships and wellbeing.

Common Types of Family Debt

Various types of debt affect families in Nigeria.

Personal loans are often used for urgent expenses.

Housing loans are another common source of debt.

Credit card debt can accumulate quickly due to high interest rates.

School fees and medical expenses can also contribute significantly.

Social and Economic Implications

Debt can limit a family’s financial freedom.

High debt levels often lead to stress and anxiety.

Moreover, it can affect children’s education and health.

Families may face difficult choices when prioritizing expenses.

This situation can create a cycle of poverty for many households.

Parenting Made Just for You

Get personalized Parenting Solutions tailored to your child’s needs. Transform your parenting journey with expert guidance in 1-3 days.

Get StartedStrategies for Managing Family Debt

Managing debt effectively is vital for family wellbeing.

Creating a budget can help track income and expenses.

Negotiating with creditors to lower payments can provide relief.

Additionally, seeking financial advice can guide better decisions.

Finally, prioritizing debt repayment can reduce financial strain.

Identifying Common Sources of Debt for Families in Nigeria

Healthcare Expenses

Healthcare costs can overwhelm many families in Nigeria.

Medical treatments often come unexpectedly, creating financial strain.

Families might rely on loans for surgeries and medications.

Access to quality healthcare often plays a role in debt accumulation.

Education Costs

Education is a priority for most families, driving them to incur debt.

School fees and related expenses can add up quickly.

Many parents take loans to secure their children’s future.

Higher education can also be a significant financial burden.

Housing and Rent

Housing often constitutes a primary financial responsibility for families.

Unveil the Perfect Name that Tells Your Family's Story

Let us help you find a name that embodies your family's values, traditions, and dreams. Our personalized consultation weaves cultural insights to create a name that's uniquely yours.

Get StartedAffording rent or mortgage payments can lead to debt.

Many families opt for loans to purchase homes.

Cost fluctuations in the housing market complicate this further.

Day-to-Day Living Expenses

Daily expenses can exceed household income, leading to debt accumulation.

Food prices and utilities increasingly burden families financially.

Unexpected costs can force families to borrow money regularly.

Social Obligations and Celebrations

Cultural expectations often result in significant spending.

Weddings, birthdays, and other events can lead families into debt.

Communal obligations often compel payments beyond their means.

These expenditures can have long-lasting financial effects.

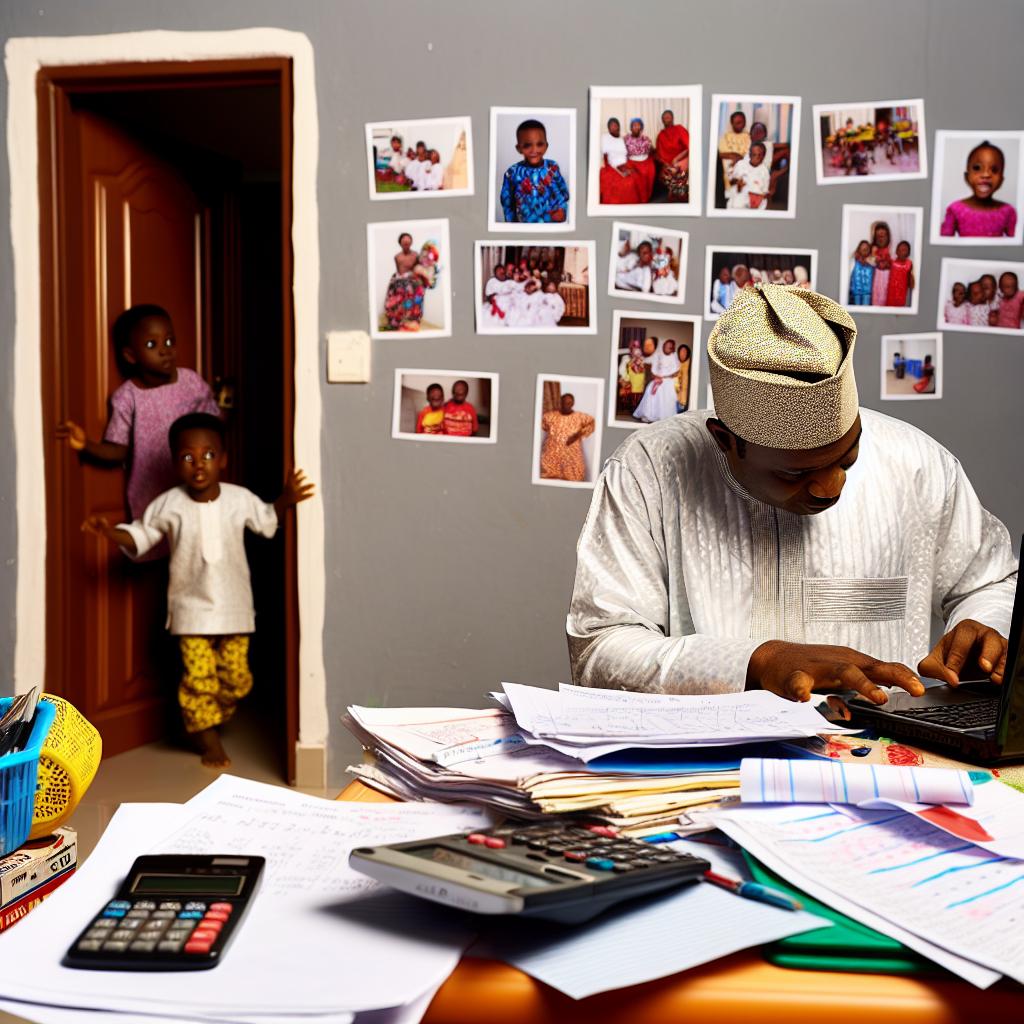

The Impact of Debt on Parenting: Balancing Financial Stress and Family Life

Understanding Financial Stress

Debt often creates significant financial stress for families.

This stress can impact daily interactions and overall family dynamics.

Parents may feel overwhelmed and anxious about meeting financial obligations.

Health issues can arise due to chronic stress from debt.

Moreover, financial worries can lead to increased arguments between partners.

Impacts on Parenting Style

Financial difficulties can alter a parent’s approach to parenting.

Some parents may become overly strict due to stress from debt.

Others may neglect their responsibilities, feeling defeated by financial pressures.

Affection and communication may decline, affecting the parent-child bond.

Children often sense the tension created by financial issues.

Modeling Financial Behavior

Children learn about managing money through their parents’ behaviors.

Debt can provide poor financial models for children to observe.

However, it also presents an opportunity for teaching about finances.

Parents can discuss budgeting and saving with their kids.

Transparency enhances children’s understanding of financial responsibility.

Creating a Supportive Environment

It’s crucial to maintain a supportive family environment despite financial troubles.

Engaging in open discussions about money can alleviate some burdens.

Family meetings can foster cooperation when dealing with debt.

Encouraging teamwork helps everyone feel involved in the financial plan.

Developing Coping Strategies

Finding ways to cope with financial stress is essential for all family members.

Practicing mindfulness can reduce stress and improve family interactions.

Setting realistic financial goals helps maintain focus and motivation.

Families can also explore community resources or financial counseling.

Networking with other families can provide additional support and insights.

Find Out More: Raising Financially Savvy Kids: Smart Money Habits for Nigerian Families

Strategies for Budgeting Effectively While Raising Kids

Assess Your Current Financial Situation

Begin by taking stock of your family’s income and expenses.

Make a detailed list of your financial obligations.

Include debts, utility bills, groceries, and school fees.

This evaluation helps you see where you stand financially.

Create a Realistic Budget

Next, draft a budget that reflects your current situation.

Include all essential expenses and some discretionary spending.

Stick to this budget consistently to manage your finances better.

Use budgeting apps or spreadsheets to track your spending.

Prioritize Debt Payments

Identify which debts should be addressed first.

Focus on high-interest debts to save money in the long run.

Consider consolidating loans for better management.

Make regular payments, however small, to keep debts in check.

Involve the Family in Financial Planning

Engage your spouse and children in budget discussions.

Teach your kids about the value of money early on.

Encourage everyone to suggest ways to save expenses.

This approach fosters a supportive financial environment.

Explore Additional Income Streams

Look for opportunities to increase your family’s income.

Consider freelance work, part-time jobs, or selling crafts.

Utilize your skills or hobbies for extra cash flow.

This can relieve some financial pressure you’re experiencing.

Set Short-Term and Long-Term Goals

Define your family’s financial goals clearly.

Set achievable short-term goals for immediate relief.

Establish long-term goals to motivate sustained effort.

This helps maintain focus on your financial health.

Track Progress and Adjust as Necessary

Regularly review your budget and financial situation.

Adjust your plan as your family’s needs change.

Stay flexible to accommodate unexpected expenses.

Celebrate small victories to maintain motivation.

You Might Also Like: Smart Financial Habits for Nigerian Parents to Secure Their Children’s Future

Teaching Financial Literacy to Children

Building Knowledge from a Young Age

Financial literacy is crucial for children in Nigeria.

Understanding money can help them make informed decisions later in life.

Start by introducing basic concepts such as saving, spending, and budgeting.

Use everyday situations to explain these concepts.

For instance, when shopping, highlight the importance of comparing prices.

Encouraging Saving Habits

Encourage children to save a portion of their allowance or gifts.

Set up a savings jar or account to make it tangible.

Show them how their savings grow over time.

Celebrate milestones when they reach their savings goals.

Teaching Needs Versus Wants

Help children distinguish between needs and wants.

Use examples from their daily lives for better understanding.

Discuss how prioritizing needs is essential in budget management.

This skill will aid them in making wise financial decisions.

Utilizing Educational Resources

Leverage books, games, and apps focused on financial education.

Choose resources that are engaging and age-appropriate.

Interactive learning can significantly enhance their understanding.

Setting a Good Example

Children often mimic adult behavior regarding finances.

Model responsible financial habits in your daily life.

Discuss family budgeting and expense tracking openly.

This will reinforce the practical aspects of financial literacy.

Encouraging Open Discussions About Money

Encourage children to ask questions about money.

Create a safe space for discussing financial topics.

Regular conversations will normalize the subject of finances.

This can lead to a deeper understanding and comfort with financial matters.

Learn More: Smart Financial Planning for Raising a Family in Nigeria on a Budget

Negotiating with Creditors

Assess Your Financial Situation

Start by understanding your current financial status.

List all your debts and their corresponding amounts.

Determine the total debt and your monthly payments.

Analyze your income and expenditures thoroughly.

This assessment will guide your negotiations effectively.

Communicate Openly with Creditors

Contact your creditors to discuss your situation.

Be honest about your financial struggles and challenges.

Clearly explain why you need a modification.

Use a calm and respectful tone during conversations.

Build a positive rapport to aid negotiations.

Propose Realistic Payment Plans

Offer a new payment plan that suits your budget.

Calculate what you can realistically afford monthly.

Present this figure to your creditors as your proposal.

Be open to counteroffers from your creditors.

Flexibility can lead to better outcomes for both parties.

Request for Interest Rate Reduction

Ask your creditors if they can lower your interest rates.

Explain how this will help you repay the debt faster.

Present evidence of your good payment history, if applicable.

A lower interest rate can significantly decrease your payments.

This can ease your financial burden while raising kids.

Document All Agreements

Ensure to document all agreements made during negotiations.

This includes payment plans and interest rate reductions.

Request written confirmation of new terms from creditors.

Keep copies of all communications for your records.

Documentation protects you in case of misunderstandings.

Consider Professional Help

If necessary, seek help from a credit counseling service.

These professionals can provide valuable advice and support.

They can negotiate on your behalf and find solutions.

Look for reputable organizations within your locality.

Ensure they have a good track record in similar situations.

See Related Content: Smart Financial Tips for Managing a Family in Nigeria

Alternative Income Streams

Exploring Diverse Options

Finding ways to increase family income is essential for managing debt.

Explore your skills and talents to create additional income sources.

Consider freelancing in your area of expertise, such as graphic design or writing.

Engaging in online tutoring can also be a fulfilling option.

Additionally, you might explore affiliate marketing through social media platforms.

Leveraging Local Resources

Utilizing local resources can open new avenues for income.

Start a small farm or garden to grow produce for local sales.

Participating in community markets can help you connect with potential customers.

Furthermore, consider using any available space for workshops or classes.

Offering lessons in music, art, or cooking can attract neighborhood interest.

Collaborating with Others

Networking with local entrepreneurs can provide valuable insights.

Consider partnering with others to start a small business venture.

This collaboration can reduce financial risks and expand your reach.

Engaging in community projects may also lead to new opportunities.

Find local organizations that support entrepreneurs for guidance and resources.

Utilizing Technology

Technology can significantly enhance income generation opportunities.

Exploring e-commerce can broaden your market beyond local areas.

Create an online store to sell handmade products or digital downloads.

Also, consider utilizing apps for gig work, such as ride-sharing or delivery services.

These platforms can help you earn extra income at your convenience.

Community Support Systems: Leveraging Family and Friends for Financial Help

Importance of Community Support

Community support is crucial for families managing debt in Nigeria.

Friends and family can offer both emotional and financial assistance.

Furthermore, they understand the cultural context of your struggles.

Building Strong Relationships

Invest time in maintaining relationships with family and friends.

Strong connections create a support network during tough financial times.

Regular communication keeps everyone informed about your needs.

Open Conversations About Finances

Start discussions about financial challenges with trusted loved ones.

This transparency fosters understanding and cooperation.

Additionally, it opens doors for potential solutions and resources.

Seeking Assistance

Don’t hesitate to ask family and friends for help when needed.

They may be willing to offer loans or gifts to ease your burden.

Moreover, they might have valuable advice based on their experiences.

Participating in Community Initiatives

Engage in community groups aimed at financial education.

These groups often provide resources for debt management.

Learning together with others can reduce your financial stress.

Establishing Financial Accountability

Create a support system that allows for accountability in financial decisions.

Regular check-ins with family and friends can help you stay on track.

They can provide motivation and encouragement in tough times.

Leveraging Social Networks

Utilize social media and community platforms for support and resources.

Many online groups focus on financial literacy and debt management.

Connecting with others can provide guidance and comfort.